The increased at-home consumption habits that have formed since the pandemic have helped several food companies’ retail operations. Their food service business is also seeing an increase in sales as people go out and get back to their normal lives. Companies have capitalized on growing demand through constant brand-building efforts, including consumer-centric innovation and acquisitions. Given that consumers are becoming more health conscious, companies have invested specifically in healthy products (especially since the pandemic).

Additionally, companies are doing everything in their power to combat the headwinds of inflation. Food companies are grappling with rising costs of raw materials, packaging and transportation. Rising labor costs due to labor shortages are also a negative aspect. Players are raising product prices and taking stronger savings and restructuring measures to meet these challenges.

Either way, we used the Zacks Stock Screener to pick the top three food stocks with a market capitalization of at least $1 billion. These stocks also sport a value score of A, making them even more appetizing. With strong fundamentals and solid potential, these food stocks could add flavor to investors’ New Year’s palettes.

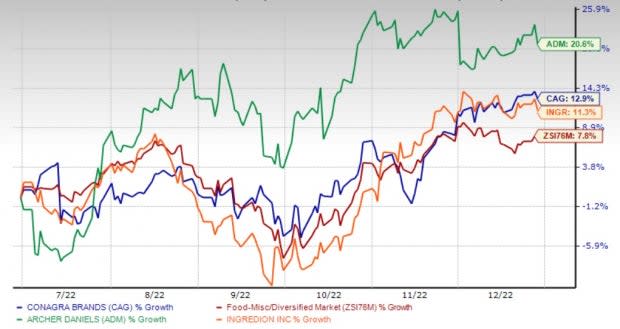

Image Source: Sachs Investment Research

3 delicacies for 2023

Conagra Brands, Inc. CAG is worth a visit. The $18.5 billion market capitalization company benefits from efficient pricing and continued execution of his Conagra Way playbook. Strong performance in the frozen and snacks category and a recovery in the foodservice business are supporting Conagra. CAG has announced additional price increases to combat inflation. This will take effect in the second quarter of fiscal year 2023. We believe efficient pricing and innovation are likely to boost sales in fiscal 2023.

Organic net sales in 2023 are expected to grow 4-5% year-over-year. Adjusted EPS growth for him is assumed to be 1-5%. Conagra’s Zacks Consensus estimate for his earnings per share for fiscal 2023 increased by one penny to $2.48 over the past 30 days, suggesting a 3.8% growth from the previous year’s reported value. The stock price of the #2 (Buy) company on the Zacks Rank has surged 12.9% over the past six months. The company’s long-term EPS growth is 7.2%.you can see See the full list of Zacks #1 Rank stocks for today here.

Archer Daniels Midland Company ADM’s share price is up 20.6% over the past six months. In its third-quarter 2022 earnings call, management said ADM is poised to finish his 2022 on a solid note and maintains momentum in 2023. The company’s third quarter results were strengthened by strong global demand, benefiting from integrated global value. The expertise of his ADM team in navigating chains, solid product portfolios and dynamic market conditions.

Archer Daniels is making great progress on three strategic pillars: Optimize, Drive and Grow. The Zacks Rank 2 company benefits from strong performance in the nutrition segment. ADM’s Zachs consensus estimate for his 2023 earnings per share increased from $6.19 to $6.34 in the last 60 days. The company has a market capitalization of $51.4 billion and a long-term EPS growth of 7.2%.

Investors can trust Ingredion Co., Ltd. INGR. The company raised its 2022 guidance when it announced solid Q3 2022 results. His $6.4 billion market capitalization company is benefiting from strong demand across core and specialty ingredients. In addition to this, active price controls in all regions have helped INGR to counter rising input costs.

The Zachs Rank 2 stock has gained 11.3% over the past six months. Ingredion Incorporated’s Zacks consensus forecast for 2023 earnings per share increased from $7.56 to $7.82 over the past 30 days, representing a 10.8% growth from the previous year’s reported value.

Want the latest recommendations from Zacks Investment Research? Download today the 7 Best Stocks of the Next 30 Days.Click to get this free report

Archer Daniels Midland Company (ADM): Free Stock Analysis Report

Conagra Brands (CAG) : Free Inventory Analysis Report

Ingredion Incorporated (INGR): Free Stock Analysis Report

Click here to read this article on Zacks.com.

Zacks Investment Research