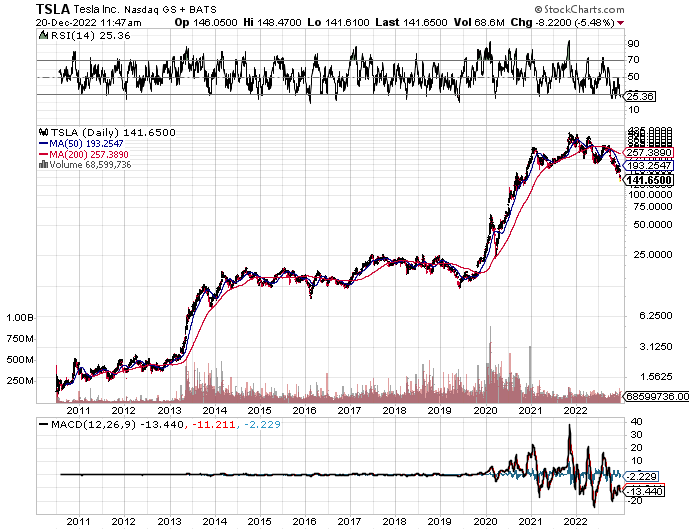

It's not trivial. Of course, nothing lasts forever. Given how successful Tesla has been over the past decade or so, this year's plunge shouldn't surprise anyone. Especially given the overall state of the broader market, the disruption in his chain of supply, global economic uncertainty and, of course, Elon Musk's attempt to buy and fix his Twitter. Many believe that led him away from his duties at Tesla. I don't know if that's true, but the optics don't look good. That said, Tesla's recent stock price drop shouldn't be misinterpreted as an indication that the company is in trouble. The car market as a whole has struggled this year. In fact, Cox Automotive's latest forecast shows that 2022 sales will be the lowest in his decade, with full-year car sales expected to be around 13.7 million, about 9% below 2021 sales. increase. And Cox's forecast for 2023 isn't all that bright. Let's see...

#1: Low-growth economy puts pressure on auto market.

Although the risk of a 2023 recession remains, Cox Automotive expects the economy to at least slow or grow very weakly as the Federal Reserve tightens monetary terms and consumers continue to struggle with high interest rates. doing. A job-destroying recession is the worst-case scenario for the auto industry, but hope remains for a soft-landing of the economy. Either way, the turbulent economy will weigh on the auto market over the next year.

#2 New car inventory levels will continue to rise.

New car production challenges are starting to decrease and inventory levels have improved significantly. Lingering supply chain and workforce challenges remain, and although capacity will not fully return to pre-pandemic levels in the foreseeable future, higher production levels and softening demand will increase the number of days of supply in 2023. , which will eventually increase vehicle options for shoppers. .

#3: Total retail sales will decline in 2023 as new car sales grow and used car sales decline.

With new car inventory levels improving as demand slows, Cox Automotive expects new car sales to grow 3% year-on-year in 2023, reaching 14.1 million units. Increased fleet sales help absolute numbers. Shortages in near-new supply, falling affordability, and shrinking buyers will challenge the used car market. Overall retail sales will decline in 2023, adding competitive pressure to the market, especially in second-hand goods.

The only uptick in this forecast was for electric vehicles.

The battery electric vehicle market continues to outpace the overall market, with another milestone of 1 million EVs sold in the US in 2023 just around the corner. The Cox Automotive team expects continued good news in the electric vehicle market.

There is no doubt that investing in the automotive market next year will definitely involve risk. However, car makers with a full lineup of electric vehicles are likely to fare much better than those who don't. These include, but are not limited to, Tesla, GM (NYSE: GM), Ford (NYSE: F), Hyundai (OTCBB: HYMTF), and VW (OTCBB: VWAGY).

We are also particularly bullish on the electric bus market, which is much more valuable than the electric passenger car market. Here are the details: https://www.energyandcapital.com/articles/did-opec-just-give-the-electric-bus-market-a-shot-of-steroids-/110552